Most of the top names in tax preparation, including TaxSlayer, advertise a “free,” edition of their software. However, most people ultimately don’t qualify and end up disappointed because the gratuitous version is intended only for those with a simple tax situation and income less than $100k like students and the military.

That’s exactly the case with TaxSlayer, so if you are hoping to do your taxes for free you’ll want to know whether or not you qualify. Here’s what you should know about the TaxSlayer Simply Free edition, and whether it’s best for you.

TaxSlayer free: Simply Free | Who Qualifies? | Military | Students | State e-file | Alternatives

Is TaxSlayer Really Free?

TaxSlayer has an edition called, “Simply Free,” which is intended for the minority of Americans with simple tax situations.

So, whether or not TaxSlayer is free depends on the complexity of your taxes and your income level. Also, if you have investments, dependents, or own a home you’re not going to qualify for Simply Free. However, there are groups like renters, the U.S. Military, and students who might find that “free” is best for their simple tax situation. Let’s examine TaxSlayer’s Simply Free edition to decide if you qualify to file at no cost.

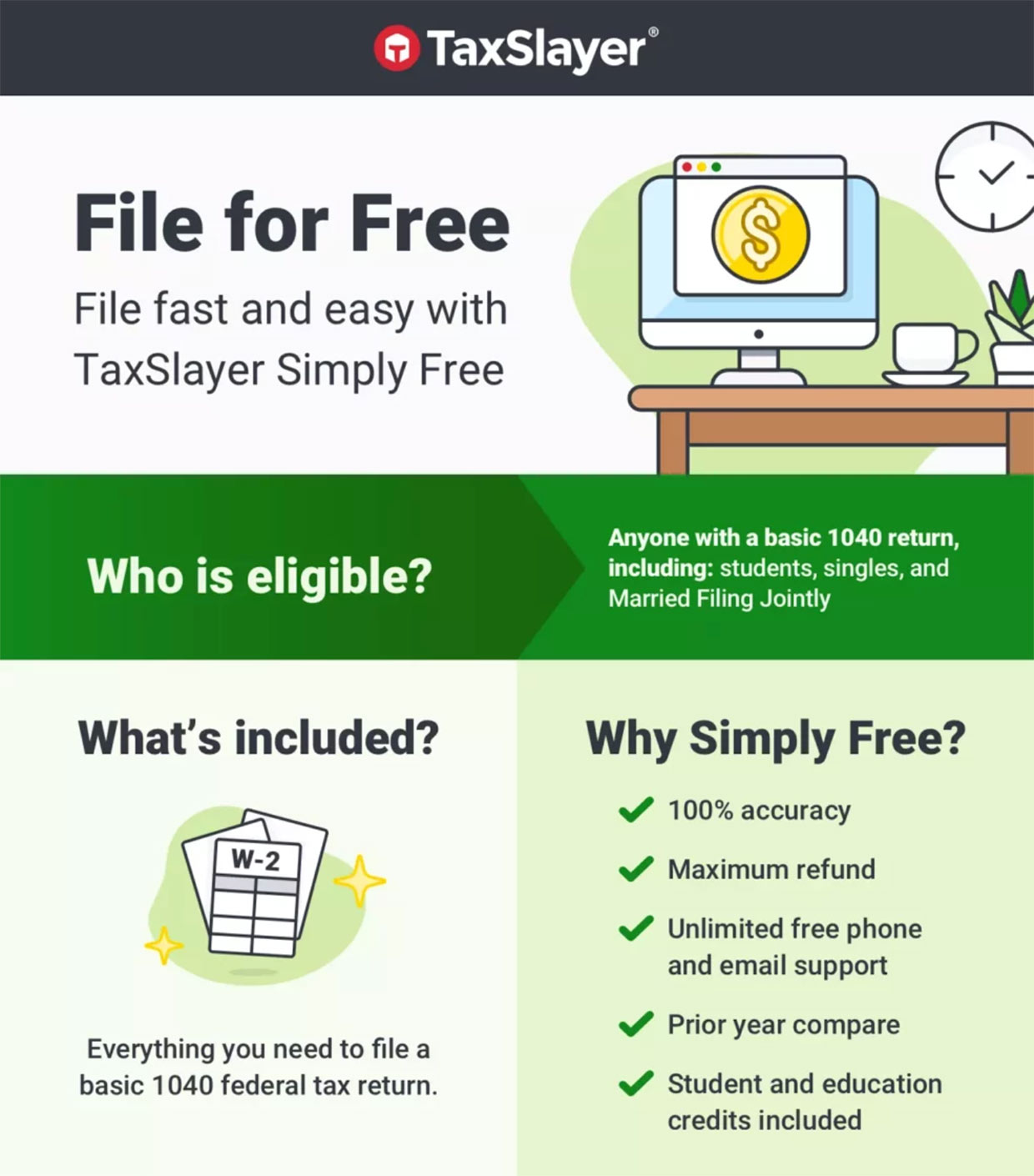

TaxSlayer Simply Free Edition

TaxSlayer Simply Free can prepare and e-file your basic 1040 tax return plus e-file both Federal and State for free if you qualify. Unlike other gratis tax prep software, Simply Free even covers student loan interest and education credits and expenses.

Here are some features of TaxSlayer Simply Free:

- Prepare, print, and e-file your simple federal and state returns online and submit them to the IRS

- Upload your prior year’s tax return from another tax service, like TurboTax

- Education expenses are covered including education credits and student loan interest

- Prior year comparison to make sure you don’t miss anything

- 100% accuracy guarantee on their calculations

- State and Federal e-file fees are waived

- Free phone & email support

Sounds pretty sweet, right? Well, they say there’s no such thing as a free lunch, right? For a majority of taxpayers that’s true and they won’t qualify for TaxSlayer’s free option. Let’s look at who can use “free.”

Who Can File Free With TaxSlayer?

Taxpayers with simple taxes who file with a basic 1040 might find that Simply Free is the best way to file their federal and state taxes at no cost with the IRS. You must meet all of these qualifications to file using TaxSlayer’s free edition, Simply Free:

- Your taxable income is less than $100k

- You are filing with a basic 1040 or W2

- Your filing status is single or filing jointly

- Your income is wages may include wages, salary, tips, and/or unemployment compensation

- Taxable interest of $1500 or less

- You claim no dependents

- You claim the standard deduction (not itemized)

- You and your spouse are under age 65

Tip: If you claim the American Opportunity Tax Credit (AOTC) or Lifetime Learning Credit (LLC) you still may be able to file for free.

Who Can NOT Get TaxSlayer For Free:

The majority of taxpayers can not file for free, including those who have the following tax situations:

- Itemized deductions (Schedule A)

- Earned Income Tax Credit (EITC)

- Stock or crypto sales

- Rental property income (Schedule E)

- Married filing separately

- Filing status is head of household or qualified widower

- Receive Social Security benefits

- Claim gambling winnings

- Side hustles with 1099 income and deductions

- Foreign earned income

- Distributions from a pension, IRA, or annuity

Do you have any of the conditions above? If so, you likely can’t file without cost and are encouraged to use TaxSlayer’s relatively inexpensive Classic edition.

Why isn’t TaxSlayer usually free? The leading tax software brands have a lot of expenses including product development, legal fees, customer support, and advertising. While TaxSlayer does offer their product for free to those with simple tax situations, their business model depends on the majority of people paying to subsidize the minority who pay nothing.

TaxSlayer Is Free for Military

If you are active duty U.S. Military you can file your federal return for $0 with TaxSlayer Classic and enjoy all the features of their most popular edition while paying only the $44.95 state filing fee. You won’t need a promo code but will have to verify your active duty status when completing your return.

Unlike Simply Free, the Classic Edition finds all military-related deductions and imports W-2s and 1099s to autofill your income and wages. You can also quickly import information from last year’s return to save time.

Is TaxSlayer free for veterans? There is no specific discount for veterans or retired U.S. military and you must be active-duty to file free with TaxSlayer Classic Edition. However, Veterans and USAA members with simple taxes can take advantage of Simply Free if they qualify. Also, be sure to check today’s promotion to save up to 20%.

Have more questions about TaxSlayer for the military? Check out their hub for military filing here.

Is TaxSlayer Free for Students?

Are you wondering whether TaxSlayer is free for college students and how you are going to pay off your mountain of student debt as a barista?

TaxSlayer does not have a specific discount or free version for college students. However, students with simple 1040 taxes can file with TaxSlayer’s $0 Simply Free edition if they qualify which also covers your student loan interest and education credits. Learn more

What If I Can’t File for Free With TaxSlayer?

Most people realize they can’t file at no cost with TaxSlayer Simply Free and are left looking for the next best option. That usually means you’ll have to pay to file as the IRS free editions of other brands like TurboTax and TaxAct have similar qualifications as TaxSlayer.

If you don’t qualify for free, consider TaxSlayer’s full-featured Classic Edition which costs about $38 before any potential discount plus a state filing fee. Classic covers all tax situations with no restrictions due to forms like Schedule A.

Even though you might have to pay for TaxSlayer, the good news is that the Classic Edition is more comprehensive and should find every tax deduction that you qualify for. You might think of paying for a better edition as an investment as a single missed deduction could cost you many times more than the cost of their software!

Why is TaxSlayer charging me a fee? If you start your taxes for free with TaxSlayer you’ll have to meet numerous conditions to stay with the free edition. If anything disqualifies you from filing free, (like your income level or claiming dependents) you’ll be asked to upgrade to one of their paid editions like Classic which handles more complex tax situations. All editions except Simply Free also charge a fee to file your state taxes.

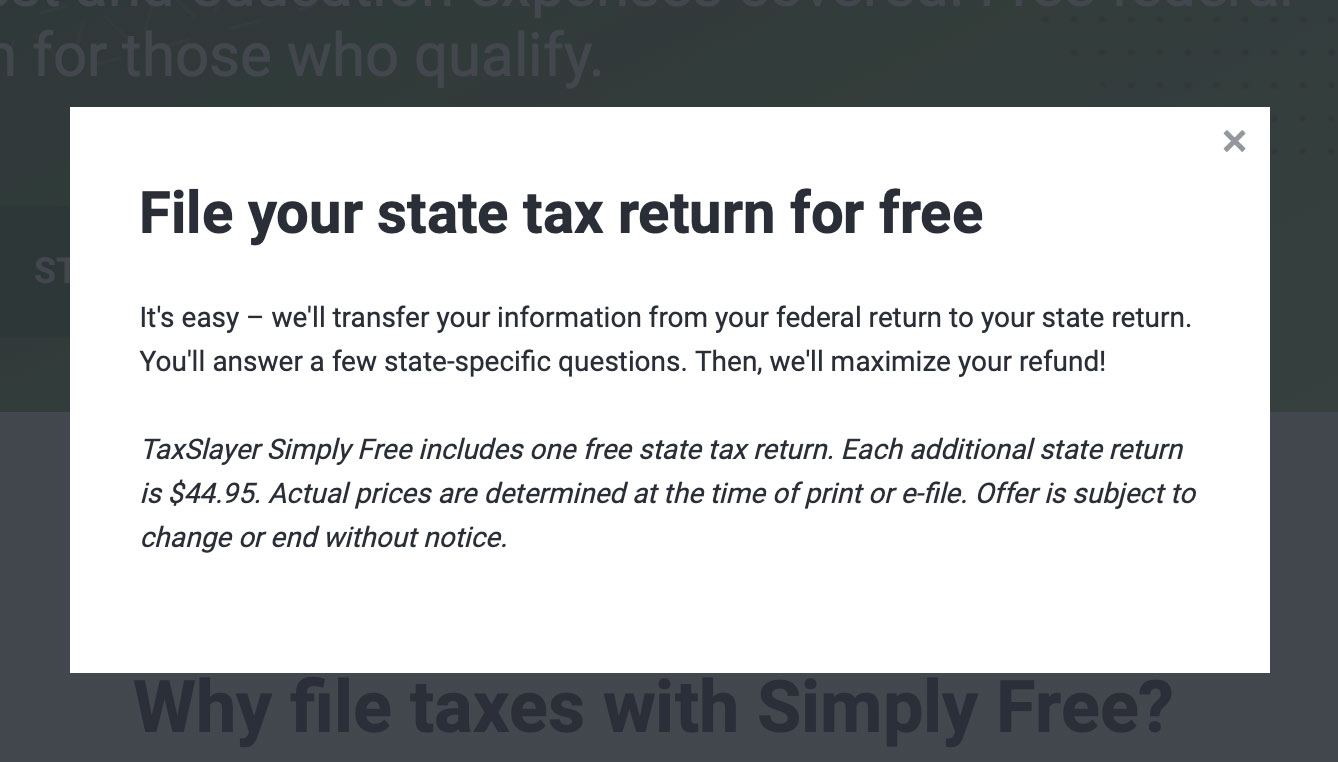

Is TaxSlayer Free for State?

Most of the time you will have to pay to file your state taxes. However, with TaxSlayer’s free edition called “Simply Free” qualified taxpayers can file their simple federal taxes plus one state return at no cost. However, if you don’t meet the criteria you will have to pay a fee of $44.95 per state e-file.

Did you know that Texas, Alaska, Iowa, Florida, and Pennsylvania top the list of tax-friendly states to retire according to Kiplinger?

I Hope You Don’t Qualify for Simply Free

If you have a simple tax situation then it makes sense that you don’t have to pay to file your taxes. While I do hope that you can get TaxSlayer at no cost, I hope you make too much money to qualify. That’s not a bad problem to have!

Plus, you can’t file free with gambling winnings, crypto capital gains, or kids, and those little dependents make for great tax deductions!

Anyway, thanks a lot for stopping by Pretty Sweet, and even though we all hate taxes, I hope yours are relatively painless this year.