You’ve probably seen all of those commercials advertising that you can file “free” with Intuit TurboTax, right? While they do offer a free version, a minority of customers qualify. So, who are the lucky minority of U.S. taxpayers who can actually file their Federal and State tax return for free online with TurboTax?

The short answer is that people with a relatively simple tax situation can usually file free*, but there’s more that you should know. Here’s today’s best promotion plus who can file free, who can’t, and why claiming to be “free” has stirred up a lot of controversy for TurboTax.

TurboTax: Who can use free? | Who can’t file free | Income limit | Free is misleading | Reddit complaints

Who Can File Free With TurboTax?

TurboTax does offer a Free Edition that’s suitable for very simple tax situations and you can learn about it here on their website. Here’s who might qualify and file their Federal and State taxes for free:

- Wage Earners: Those with income from wages or salaries, where taxes are typically withheld and reported on a W-2 form.

- Basic Filers: Individuals who only need to file with simple tax situations, such as claiming the standard deduction without itemizing.

- Unemployment Income: If you received unemployment income during the year, and that’s the extent of your complexity, you’re covered.

- Limited Interest and Dividends: Filers who have a small amount of interest or dividend income as reported on forms 1099-INT or 1099-DIV.

- Eligible Credits: Those claiming straightforward tax credits like the Earned Income Tax Credit or the Child Tax Credit without additional complications.

Now, before you get excited and assume you qualify for the “Free” Editon of TurboTax, let’s talk about who does not qualify to use Free.

Why You Can’t File for Free With TurboTax:

Despite the availability of a free filing option, many people find they don’t qualify for it when it comes down to the details, and that’s frustrating.

Here are five common reasons why you probably can’t use the “Free” version:

- Self-Employment: If you have any self-employment income, which includes freelance or gig economy work, you’ll need to file Schedule C to report profits or losses. This form isn’t included in the Free Edition.

- Itemized Deductions: If you choose to itemize deductions (like mortgage interest, property taxes, medical expenses, and charitable donations) instead of taking the standard deduction, you’ll need a more advanced version to handle this.

- Investment Income: Earning income from stocks, bonds, rental properties, or other investments usually involves additional forms like Schedule D for capital gains and losses, which are not supported by the free service.

- Retirement Contributions: Issues like early withdrawals from retirement accounts or complex IRA contributions necessitate more detailed filings.

- Health Savings Accounts (HSAs): Contributions to or distributions from HSAs also require additional forms that aren’t included in the free package.

Those are some pretty common exemptions and they aren’t mentioned in commercials! Here’s why the public and even the FTC got frustrated with TurboTax’s claims of being free.

Tip: If your adjusted gross income was less than $79k, the IRS Freee File Program has free tax prep software here to file your Federal taxes!

What Is the Income Limit for TurboTax Free?

While the IRS Free File program has an adjusted gross income (AGI) limit of $79,000 to file free, TurboTax does not have a limit to qualify for their Free Edition. Here’s what their website says about any income limit to use Free:

“There is not a limit on the AGI when using the TurboTax Free online edition. The TurboTax Free online edition is for very simple tax returns that do not require any other form or schedule other than the Form 1040. If your tax data requires entry on any other form or schedule then you must upgrade to the Deluxe edition or higher.”

While there is no income limit to file free, you’ll probably find that the basic features of the Free Edition don’t meet your requirements if you don’t have simple taxes.

Are TurboTax “Free” Advertisements Misleading?

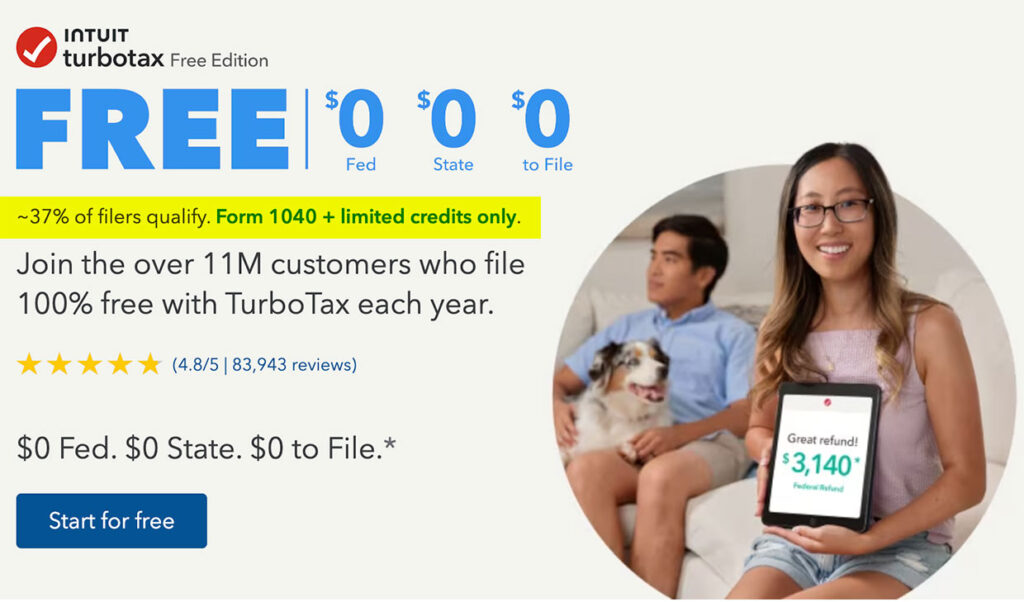

TurboTax has aggressively marketed its Free Edition for years. However, a majority of customers learn that they don’t qualify for the free version. This is frustrating and why newer commercials have had to significantly dial back the promise of “free,” file which is now accompanied by a disclaimer.

Compare this newer ad to the “free, free, free” campaign, and you’ll see what I’m talking about:

Here are 5 reasons that frustrated customers feel that “free” TurboTax is misleading:

- Overpromising: The advertising strongly promotes the idea of free filing, using phrases like “File for $0” or “Free Guaranteed.” This implies a wider availability than is the case.

- Early Commitment: Many users start their tax returns under the assumption that they won’t have to pay anything. They enter a lot of personal data and spend time on the platform, only to find out later that they need to upgrade to a paid version to complete their filing.

- Upselling: Once you’re halfway through, finding out you need a more comprehensive service to cover your tax needs means either starting over elsewhere or reluctantly paying TurboTax. This feels like a bait-and-switch to many users.

- Complexity in Tax Laws: The complexity of U.S. tax laws means it’s easy for individuals to misjudge their own tax situation. What seems like a straightforward case to a layperson may actually involve complexities that mandate a paid version.

- Selective Details: The details about what is included in the free filing are often buried in fine print or only become clear as you progress through the filing process.

Reddit Users Complain That TurboTax Is Not Free:

“I have been told the best things in life are free ~ I found them very expensive.” – E.A. Bucchianeri

Many people on Reddit complain that TurboTax is not really free due to a common experience: they are drawn in by ads promising free filing, but as they go through the process, they often find they need to pay to complete and file their taxes.

This usually happens because their tax situations require forms or features that are not included in the Free Edition. For example, Reddit users with freelance income, investments, or itemized deductions find themselves needing to upgrade to a paid version to handle these aspects. This experience feels like a bait-and-switch to many Reddit users, leading to frustration and complaints on Reddit.com, as they feel misled by the initial promises of free service.

It’s not just those crazy Reddit users claiming that TurboTax is not free, as the Federal Trade Commission (FTC) waded in, too.

The FTC Argued That TurboTax is Not Usually Free:

The situation with TurboTax and the “free” claims caught the attention of the Federal Trade Commission (FTC), which led to some significant findings and legal actions.

The FTC took issue with how TurboTax marketed its Free Edition. The core of their concern was that TurboTax advertised heavily that filing taxes was free, but this free service was only applicable to certain filers with simple tax situations. The FTC found that many consumers, attracted by these advertisements, would start their tax returns under the belief that they could file for free. However, as they progressed, a significant portion discovered that they needed to pay because their tax situations didn’t fit the narrow criteria for the free filing service.

In essence, the FTC argued that TurboTax’s marketing was misleading. The advertisements gave the impression that most taxpayers could file for free, but in reality, the majority of users ended up needing to upgrade to paid versions due to the specifics of their tax filings—like having deductions, credits, or earnings that weren’t covered by the Free Edition.

The FTC’s actions highlight a broader issue of transparency and truth in advertising, pushing for clearer communication to consumers about what they can realistically expect from products advertised as “free.” Other brands like Noom, VistaPrint, and WeightWatchers have also found themselves tip-toeing around the word “free” in their ads when offering products like free prints and free business cards.

This case against TurboTax was about ensuring that consumers aren’t lured under false pretenses and then pushed towards a paid service, which isn’t what they initially opted for based on the advertising.

Tip: TurboTax now must include this disclaimer whenever mentioning the word free: “Roughly 37% of taxpayers qualify. Form 1040 and limited credits only”

No Free Lunch or Free TurboTax for You!

“Free lunches don’t come cheap.” – Charles Petzold

They say that there’s no such thing as a free lunch and the only thing certain in life is death and taxes. Wow, that’s pretty bleak!

Anyway, while TurboTax does provide a Free Edition, it’s important to understand that its use is limited to specific simple tax situations. The company’s marketing strategies emphasize the free aspect, potentially misleading users about the true cost of filing their taxes, especially for those with slightly more complex situations.

If you’re considering using TurboTax, it’s wise to review your tax needs carefully to determine whether you truly qualify for free filing, or if you’ll need one of the paid versions. That way, you can avoid surprises and make an informed decision right from the start.

Thanks for stopping by TaxDeals.org, and good luck with your taxes. Maybe you can file at no cost after all?